Elster for small business ownersĪs a small business owner, you are legally obliged to lodge your tax return via Elster – and you also need to declare that you are applying the so-called small business regulation ( Kleinunternehmerregelung ). Employees and other non-self-employed individuals currently still have the choice between submitting their tax returns electronically or posting a printed version of their documents to their tax office. The only difference is that self-employed workers and companies are legally obliged to submit their tax documents electronically. This includes employees, freelancers and business owners as well as corporations, employers and other organisations. Using and registering with Elster is free of charge for anyone who wishes to submit their tax return electronically. Users have to create an account and can then access a variety of digital forms and documents that allow you to send information directly to your tax office. The software was introduced in 1996 to make it easier for tax payers in Germany to submit their tax returns and to reduce the amount of printed documents the tax office receives every year.

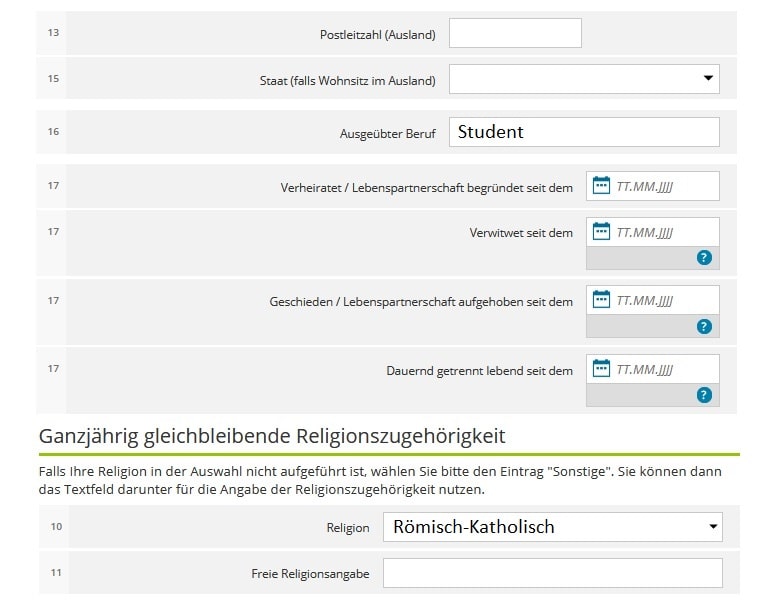

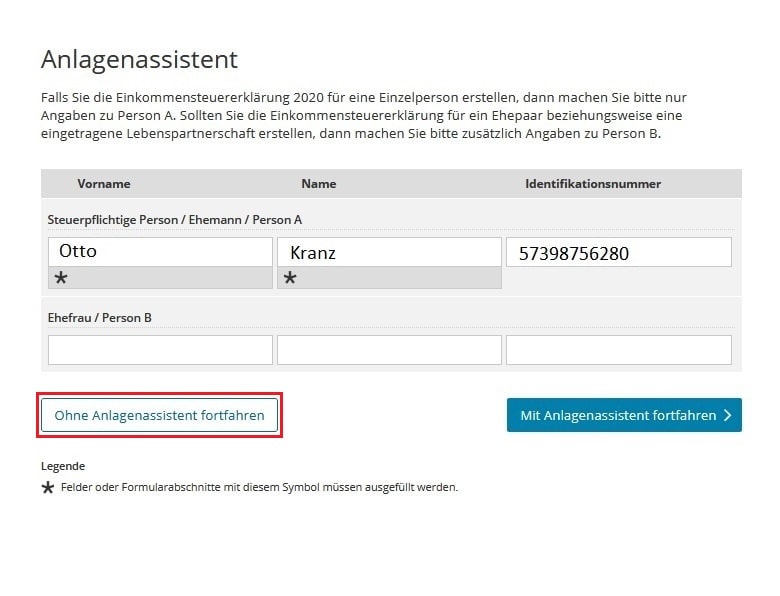

The name Elster is a shortened version of “ el ektronische St euer er klärung ”, which means electronic tax return. Using Elster to communicate with the tax officeĮlster is a free and web-based German tax software that can be used to submit tax returns and other tax-related documents to the tax office.The revenue surplus statement in Elster.The questionnaire for tax collection in Elster.Read on to learn how to create an Elster account, use the most important features, and find out about useful alternatives to this tax software. This is the name of the official German digital tax platform that you can use to lodge your tax returns and send other tax-related documents to the tax office. If you have looked into submitting your tax declaration in Germany before, then you probably ran into the word “ Elster ”.

0 kommentar(er)

0 kommentar(er)